The new love interest you have been texting over the last few months – the one you met on social media – has had to cancel your online video date due to a work emergency. You’re disappointed because this is a recurring pattern. But, you push aside your feelings of frustration. After all, this person has been helping you learn how to invest and take control of your finances. They’ve even shared an investment opportunity with you that they claim earned them incredible returns in the past. You think to yourself, “If people can find their significant other online, maybe this could work out for me too. And the returns on investments, that’s a nice added benefit.”

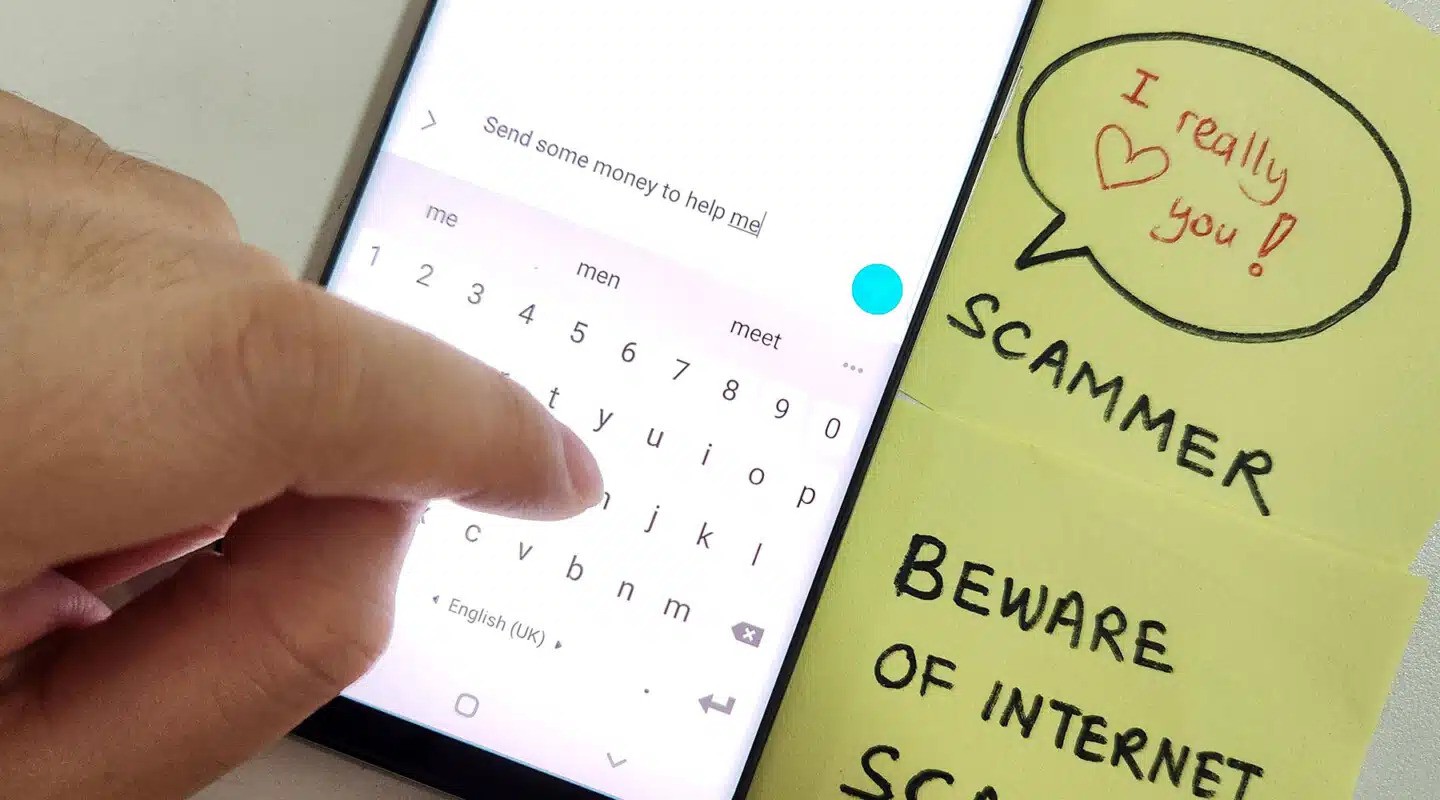

Stop. Check first. This could be the start of an online romance investment scam.

According to the Canadian Anti-Fraud Centre (CAFC), romance scams were responsible for some of the highest financial fraud losses in 2023 — costing 945 victims more than $50 million.

What is a Romance Scam?

Romance scams often involve social engineering tactics. Here a fraudster quickly builds an online relationship with the target, and then leverages the trust formed and any personal information they obtain to con the victim out of money.

Regardless of the platform where the scam originates, fraudsters follow similar patterns of trust-building through regular communication and declarations of love or friendship. Then comes the requests for money for an investment opportunity. Oftentimes, these investment offers can be tied to crypto or promises of significant returns with little or no risk.

As millions of Canadians continue to use social media and dating apps to seek new friendships and romance, these types of investment scams are becoming increasingly common.

Here are some tactics and schemes that you should be on the lookout for:

Fake Profiles and Catfishing

Catfishing, or using fake online identities, has long been a tactic used by fraudsters. These scams usually involve an attractive, but fake profile, designed to entice victims into an online relationship.

Con artists even use new technology like AI to manipulate images, videos, and voice to create a seemingly credible persona. Catfishing scams typically feature a profile that seems unrealistically perfect, like excessive wealth and good looks, an extravagant lifestyle and unfettered success.

One of the ways you can spot if the images on a profile are AI-generated is by looking for unrealistic symmetry in a person’s face or magazine-like beauty. A reverse image search can also help check if a picture is stolen or used by multiple accounts.

Military or Oil Rig Scams

This scam is a variation of catfishing. It targets Albertans by exploiting their trust in established institutions or companies, like the military or an oil company.

Scammers take advantage of the victim’s lack of knowledge about protocol for military personnel or oil rig workers when crafting these scams. Fraudsters typically claim to be dealing with a banking issue due to being deployed overseas. They request help with finances for an investment opportunity that will result in quick and guaranteed returns for both of them.

Frequent excuses like avoiding video chats due to security or network problems at their remote work location is a common red flag.

Financial Grooming or Pig Butchering

Unlike many romance scams that develop rapidly, financial grooming is often a long term and predatory scheme. This scam, often referred to as “pig butchering”, usually combines elements of a romance scam and crypto investment fraud.

In this tactic, the fraudster grooms the victim over months before encouraging them to start crypto trading. They may even offer to “manage” the crypto investment on behalf of the victim and request additional funds to be provided for a greater return.

Scammers often create fake return statements on investments to establish credibility. They may even pay early but fake returns — prompting the victim to invest larger and larger sums of money. In most cases, victims only realize they have been defrauded when they try to withdraw their funds and are denied or ignored by the fraudster.

How Do You Know if You’re Being Scammed?

Typically, a romance scammer will try to move the relationship forward as quickly as possible. They employ a technique called “love bombing”, where they shower victims with extreme displays of attention and affection. The con artist may also try to establish trust by sharing “personal” details about their lives right at the beginning of a conversation.

The next step in their con is the suggestion to move your conversation to personal messaging apps. Scammers use apps like Google Chat, Snapchat, and Telegram to prevent their dating profiles from being reported.

Common red flags of a romance-based investment scam are:

- A new acquaintance you met online who claims to have insider knowledge about profitable investment opportunities.

- Directions from an online friend or acquaintance to use a specific app or platform to make investments.

- Pressure to invest immediately or lose out on a once-in-a-lifetime opportunity.

- Requests for remote access to your device to “teach” you how to invest.

- Immediate and escalating interest in your finances.

Reporting a Romance Scam:

Fraud costs Canadians millions of dollars each year. Despite the staggering impact of these scams, we know that fraud is grossly underreported as only 5-10 per cent of victims file complaints.

Remember, regardless of age, investment knowledge, or level of wealth, anyone can fall victim to an investment scam. If you believe you have been the victim of a romance-based investment scam, report it to the Alberta Securities Commission (ASC). You can register a complaint online or call us at 403.355.3888.

Want to learn more about the tactics employed by fraudsters? Check out our resources: https://checkfirst.ca/resources/fraudsters-playbook/

Author: James MacTavish

Senior Advisor, Investor & Industry Education

Alberta Securities Commission